A guide to cash flow statements

A guide to cash flow statements

Cash flow statements were first introduced as a primary financial statement in the 1980 following the failure of Polly Peck Plc which whilst profitable ran out of cash.

A cash flow statement is a useful document in that it shows how cash is generated in a business and how it is used, the resulting movement reflecting in the difference between opening cash and cash equivalents and the closing cash position in the period in question.

The standard format of a cash flow is designated by FRS 1 (Financial Reporting Standard 1) but there are other formats which are useful such as CFADS – Cash Flow available for Debt Service, which is often used by the UK banks to evaluate loan applications.

What is really useful with this primary statement is that you can easily see what sort of cash generation a business makes and what proportion of that cash flow gets absorbed in servicing debt, if there isn't much spare cash generated then that is a sure sign of increased risk. In the event of an unexpected crisis a business with only modest cash generative abilities will quickly run into difficulty. Whereas one that is highly cash generative will fair much better.

Cash flow statements are only included within accounts if a company is over above the threshold for filing smaller company accounts. This makes sense as larger more complex companies have great cash flow funding needs.

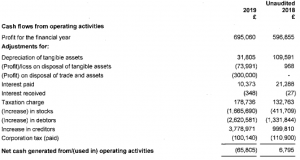

Here is an example of a Cash flow statement produced under UK GAAP.

This is reproduced from companies house data and is from GB Tyres (UK) Ltd As you can see the statement is split into sections covering operating activities, investing activities and financing activities.

The first section, cash from operating activities, shows the profit for the financial years from the profit and loss statement, then adds back items which don't involve cash movements or are related to the other activities within the financial statement. Depreciation for example does not involve the movement of cash and as an accounting convention that spreads the cost of an asset over its expected useful life. By adjust for similar items this section then comes down to the Net cash generated from operating activities.

The next section cash flows from Investing activities shows how a business uses its free cash from operating activities to purchase long term assets such as fixed or intangible assets, and what interest is paid on loans and HP leases.

purchase long term assets such as fixed or intangible assets, and what interest is paid on loans and HP leases.

This then takes the cash flow statment down to the line Net Cash from \used in investing activities.

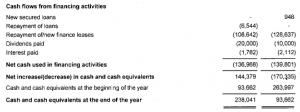

The final section cash flows from financing activities, shows how the business is funded, so in this section we see; new secured loans, repayments of loans, new finance leases, dividends and interest paid.

The very final section of the cash flow shows, cash at the start of the year, and cash at the end, with a movement which then equals the other items within the cash flow statement. Cash equivalents are items which are very close to becoming cash, for example credit card receivables held within a rolling reserve by a merchant provider.

It is always worth spending some time looking into a companies cash flow statement to really get a good understanding of how a business is running and how it is being financed.

Following the Covid-19 pandeThemic banks are placing increased importance on understanding the cash flows within a business and will typically ask for this as part of regular monthly management information (MI).

Bio Adrian is the CEO of reportingaccounts and also can be found on ePhotozine